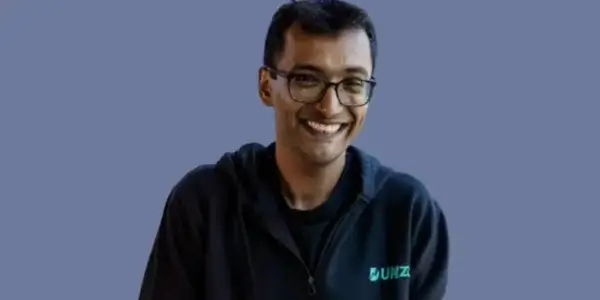

Dunzo, the hyperlocal delivery startup backed by Reliance Retail, is reportedly facing significant leadership changes after a tumultuous year marked by financial challenges and operational setbacks. According to recent reports, founder and CEO Kabeer Biswas may be stepping down from his role, signaling a critical juncture for the company as it navigates a highly competitive market.

A Year of Turmoil

Founded in 2015 by Kabeer Biswas, Dunzo quickly became a household name in India’s urban centers, offering on-demand delivery services ranging from groceries to household essentials. The company gained substantial attention and investment, notably from Reliance Retail, which acquired a 25.8% stake with a $200 million investment in early 2022.

However, the past year has been fraught with difficulties for Dunzo. The company has grappled with cash flow issues, leading to delayed salary payments and multiple rounds of layoffs. In April 2023, Dunzo reportedly deferred employee salaries and laid off a significant portion of its workforce, citing the need to restructure operations and cut costs.

Financial Struggles and Funding Challenges

Dunzo’s financial woes have been exacerbated by intense competition in the quick commerce sector. Rivals like Swiggy Instamart, Blinkit (acquired by Zomato), and Zepto have intensified the battle for market share, often engaging in aggressive discounting strategies that strain profitability.

Efforts to raise additional capital have faced hurdles. Dunzo initially sought to secure $300 million in funding but managed to raise only a fraction of that amount. The shortfall has put pressure on the company’s operations and expansion plans. Despite Reliance’s backing, the need for fresh capital remains critical to sustain growth and compete effectively.

Potential Exit of Founder Kabeer Biswas

Amid these challenges, reports have emerged suggesting that Kabeer Biswas may exit the company he founded nearly a decade ago. While official statements are yet to be released, insiders indicate that discussions are underway regarding leadership restructuring. Biswas’s departure could herald significant changes in Dunzo’s strategic direction, potentially impacting its partnerships and market positioning.

Strategic Shifts and Operational Changes

In response to financial constraints, Dunzo has been re-evaluating its business model. The company has shifted focus towards its business-to-business (B2B) logistics service, Dunzo Daily, aiming to leverage existing infrastructure for higher efficiency and better margins. This pivot reflects a broader trend in the quick commerce industry, where companies are seeking sustainable operations over rapid but costly expansion.

Additionally, Dunzo has been exploring cost-cutting measures, including reducing delivery fleets and renegotiating vendor contracts. However, such strategies come with the risk of affecting service quality and customer satisfaction, which are crucial in the hyper-competitive delivery market.

Implications for Stakeholders

For investors like Reliance Retail, the potential exit of Biswas raises questions about the future of their investment and the company’s trajectory. Reliance’s support has been a cornerstone for Dunzo, providing not just capital but also access to a vast retail network. Any leadership changes will need to be managed carefully to maintain investor confidence and operational stability.

Employees and partners are also watching developments closely. The layoffs and salary delays have already impacted morale, and uncertainty about leadership can exacerbate concerns about job security and the company’s long-term prospects.

The Road Ahead

Dunzo’s situation underscores the broader challenges facing quick commerce startups in India. High operational costs, thin margins, and the relentless push for customer acquisition have made profitability elusive for many players in the sector.

The company’s ability to navigate this period of uncertainty will depend on several factors:

- Leadership Transition: Effective management of any leadership changes will be crucial to maintain strategic focus and operational continuity.

- Financial Restructuring: Securing additional funding or restructuring existing debts could provide much-needed liquidity to stabilize operations.

- Market Differentiation: Developing unique value propositions beyond price competition could help Dunzo retain and grow its customer base.

Conclusion

The potential departure of founder Kabeer Biswas marks a pivotal moment for Dunzo. As the company grapples with financial strain and stiff competition, decisive action is required to steer it back on course. Stakeholders will be keenly observing how the situation unfolds, hoping for a resolution that secures Dunzo’s place in India’s burgeoning quick commerce landscape.

Disclaimer: This article is based on information available up to January 3, 2025. Official statements from Dunzo or Kabeer Biswas were not available at the time of writing.

Anantha Nageswaran is the chief editor and writer at TheBusinessBlaze.com. He specialises in business, finance, insurance, loan investment topics. With a strong background in business-finance and a passion for demystifying complex concepts, Anantha brings a unique perspective to his writing.