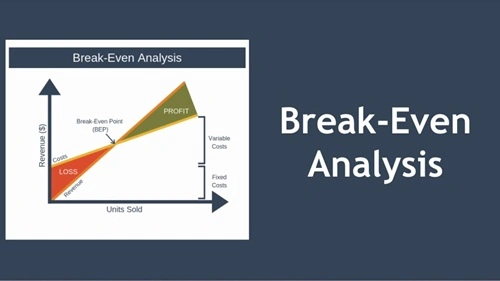

Break-even analysis is a financial tool used by businesses to determine the point at which total revenues equal total costs, meaning there is no profit and no loss. This critical point, known as the break-even point (BEP), helps businesses understand how much they need to sell to cover costs and start making profits.

Break-even analysis is widely used by startups, small businesses, and large corporations in India to make pricing, cost management, and investment decisions. It provides insights into fixed and variable costs, sales volume, and profitability margins, making it an essential tool for business planning and risk assessment.

However, break-even analysis also has limitations, such as ignoring market conditions, assuming constant sales prices, and not considering external business factors. In this article, we explore the advantages and disadvantages of break-even analysis to help businesses make informed financial decisions.

Quick Overview: Break-Even Analysis Advantages & Disadvantages

| Advantages | Disadvantages |

|---|---|

| Helps Determine Profitability Threshold | Assumes Constant Sales Price & Costs |

| Assists in Pricing & Cost Control | Ignores Market Demand & Competition |

| Aids in Financial Planning & Decision-Making | Does Not Consider External Factors (Inflation, Economic Changes, etc.) |

| Useful for Startups & New Business Ventures | Not Suitable for Businesses with Multiple Products |

| Helps in Risk Management & Investment Evaluation | Requires Accurate Data for Reliable Results |

| Improves Resource Allocation & Operational Efficiency | Ignores Qualitative Business Aspects (Brand Value, Customer Preferences, etc.) |

Advantages of Break-Even Analysis

1. Helps Determine Profitability Threshold

Break-even analysis allows businesses to identify the minimum sales volume required to cover costs. This helps:

- Entrepreneurs understand when they will start making profits.

- Businesses set realistic sales targets.

For example, if a bakery’s fixed costs are ₹1,00,000 per month and it sells cakes at ₹500 per unit with a variable cost of ₹250 per unit, the break-even point can be calculated as:

BEP=Fixed CostsSelling Price per Unit – Variable Cost per Unit=1,00,000500−250=400 cakes\text{BEP} = \frac{\text{Fixed Costs}}{\text{Selling Price per Unit – Variable Cost per Unit}} = \frac{1,00,000}{500 – 250} = 400 \text{ cakes}

This means the bakery needs to sell at least 400 cakes per month to break even.

2. Assists in Pricing & Cost Control

Break-even analysis helps businesses:

- Set optimal product pricing based on cost structure.

- Identify unnecessary expenses to reduce fixed or variable costs.

For example, if a manufacturer finds that their break-even sales volume is too high, they may:

- Increase product prices to reduce the required sales volume.

- Find cheaper raw materials to lower production costs.

3. Aids in Financial Planning & Decision-Making

Break-even analysis helps businesses make informed financial and operational decisions, such as:

- Deciding whether to expand production.

- Evaluating cost-cutting strategies.

- Determining if a new product launch is financially viable.

For example, a startup evaluating different business models can use break-even analysis to choose the most sustainable and profitable option.

4. Useful for Startups & New Business Ventures

Startups and small businesses often have limited resources. Break-even analysis helps:

- Estimate the initial investment required to reach profitability.

- Avoid unrealistic business goals.

For instance, a new restaurant planning its menu and pricing can use break-even analysis to determine:

- The number of daily customers needed to cover costs.

- The ideal pricing for meals to ensure profitability.

5. Helps in Risk Management & Investment Evaluation

Break-even analysis helps businesses assess financial risks before making investments. It provides a realistic view of potential profits and losses, helping:

- Investors decide whether a project is worth funding.

- Businesses understand financial risks before expanding.

For example, a manufacturing company investing in a new production line can calculate the break-even point to assess investment risks.

6. Improves Resource Allocation & Operational Efficiency

Understanding break-even points helps businesses:

- Allocate resources more effectively to profitable areas.

- Optimize labor, raw materials, and marketing expenses.

For example, an e-commerce company can identify which product categories require higher investments based on break-even analysis.

Disadvantages of Break-Even Analysis

1. Assumes Constant Sales Price & Costs

Break-even analysis assumes that:

- Sales prices remain unchanged, which is unrealistic due to discounts, inflation, and market competition.

- Fixed and variable costs remain stable, but in reality, costs may fluctuate due to supplier price changes, seasonal demand, or labor costs.

For example, a retail business using break-even analysis to set a fixed product price may fail to adjust for inflation or competitor discounts, leading to lower-than-expected sales.

2. Ignores Market Demand & Competition

Break-even analysis does not consider:

- Actual customer demand for the product.

- Competitive pricing strategies and market trends.

For example, a smartphone company setting a break-even price may find that competitor brands offer lower prices, making their pricing strategy ineffective.

3. Does Not Consider External Factors (Inflation, Economic Changes, etc.)

Break-even analysis does not account for macroeconomic factors such as:

- Inflation affecting raw material costs.

- Changes in government policies impacting business operations.

- Economic downturns reducing consumer purchasing power.

For example, a hotel business calculating its break-even point may not consider seasonal fluctuations in tourist demand.

4. Not Suitable for Businesses with Multiple Products

For businesses selling multiple products with different cost structures, break-even analysis can become complex and less effective. Each product may have:

- Different pricing and cost variations.

- Different demand patterns.

For example, a supermarket with thousands of products cannot easily determine a single break-even point due to varied product margins.

5. Requires Accurate Data for Reliable Results

Break-even analysis is only useful if:

- Businesses have accurate data on costs, sales, and pricing.

- Cost components (fixed and variable) are properly classified.

For example, if a restaurant underestimates ingredient costs, their break-even analysis may give a misleading profit estimate.

6. Ignores Qualitative Business Aspects (Brand Value, Customer Preferences, etc.)

Break-even analysis focuses only on numerical costs and revenues, ignoring:

- Brand positioning and market perception.

- Customer loyalty and repeat business potential.

- Business differentiation factors (quality, innovation, service levels, etc.).

For example, luxury brands like Apple or Tesla may have higher costs, but their brand value allows them to maintain profitability beyond just break-even calculations.

Who Should Use Break-Even Analysis?

Ideal for:

✔ Startups and new businesses evaluating profitability.

✔ Manufacturers & retailers setting product pricing strategies.

✔ Investors & lenders assessing financial feasibility.

✔ Business owners making expansion or cost-cutting decisions.

Not Suitable for:

✘ Large businesses with multiple product lines.

✘ Industries affected by frequent price & demand fluctuations.

✘ Businesses relying on qualitative factors (brand loyalty, innovation, etc.).

Conclusion: Is Break-Even Analysis a Useful Business Tool?

Break-even analysis is a valuable financial planning tool that helps businesses determine profitability, manage costs, and make informed decisions. However, it should not be used in isolation—it must be combined with market research, competitor analysis, and external economic factors to ensure realistic financial forecasting.

For businesses that use break-even analysis alongside other financial tools, it can be a powerful method to enhance profitability and reduce risks.

Anantha Nageswaran is the chief editor and writer at TheBusinessBlaze.com. He specialises in business, finance, insurance, loan investment topics. With a strong background in business-finance and a passion for demystifying complex concepts, Anantha brings a unique perspective to his writing.