In today’s fast-evolving digital landscape, the integration of technology into banking services has revolutionized the way financial transactions are managed in India. Among the leading innovators in this realm is Axis Bank, whose digital initiatives are designed to simplify financial processes for its vast clientele. One such initiative is the Tallyman Axis Login—a gateway to the Axisbank Collection Official Website that brings together advanced features, seamless usability, and robust security measures to provide an unmatched digital banking experience.

The Tallyman Axis Login serves as the secure entry point for users to access the comprehensive suite of services offered on the Axisbank Collection Official Website. This portal is meticulously designed to ensure that customers have a smooth, hassle-free experience while managing their transactions. With a user-centric interface and stringent security protocols, the login platform not only protects sensitive financial information but also streamlines various collection-related activities, making it an essential tool for both individual and corporate users.

Key Features of the Axisbank Collection Official Website

The official website stands out due to its rich assortment of features that cater to a wide spectrum of banking needs:

-

User-Friendly Interface: The website is built with simplicity at its core, ensuring that even those who are less tech-savvy can navigate it with ease. A clean layout, intuitive menus, and well-organized information make accessing various services straightforward and efficient.

-

Robust Security Protocols: With cyber threats on the rise, Axis Bank has placed significant emphasis on security. The Tallyman Axis Login employs state-of-the-art encryption technologies and multi-factor authentication (MFA), ensuring that each login session is secure. This rigorous security framework safeguards personal data and transaction details against unauthorized access.

-

Real-Time Transaction Updates: One of the standout features is the ability to view real-time updates on transactions. Whether it’s a payment receipt or collection update, the information is available instantly, giving users complete transparency over their financial activities.

-

Comprehensive Collection Services: The official website is not just a login portal—it is a one-stop solution for all collection-related services. Users can manage bill payments, track loan disbursements, review account statements, and even handle other banking operations seamlessly through the portal.

-

Mobile Optimization: Recognizing the growing need for on-the-go banking, the Axisbank Collection website is fully optimized for mobile devices. This ensures that users can access all the features of the portal from their smartphones and tablets, thereby maintaining productivity regardless of location.

-

Integrated Customer Support: In addition to its technical features, the website offers dedicated customer support. Whether through live chat, email, or phone support, assistance is readily available to resolve any issues or queries, ensuring a smooth user experience.

How to Use Tallyman Axis Login

Using the Tallyman Axis Login is a straightforward process designed to minimize any potential complexities:

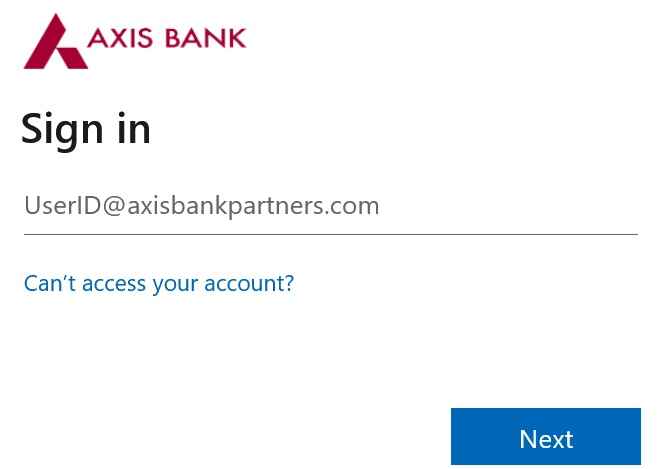

1. Access the Website: Begin by visiting the official Axisbank Collection website https://pcccollections.axisbank.co.in. The home page provides clear options and links, making it easy to locate the Tallyman Axis Login section.

2. Enter Your Credentials: Once on the login page, users need to input their unique credentials—typically a user ID and password. The platform also supports multi-factor authentication, requiring an OTP (One-Time Password) sent to your registered mobile number or email.

3. Secure Verification: After entering your details, the system performs a secure verification of your credentials. This step ensures that only authorized users gain access to the sensitive financial information and services available on the portal.

4. Navigate the Portal: Upon successful login, users are welcomed by a dashboard that provides quick access to various functionalities such as bill payment, loan tracking, and account management. The interface is designed to be intuitive, allowing even new users to quickly familiarize themselves with the platform.

Uses of the Axisbank Collection Official Website

The Axisbank Collection website is a versatile platform that serves a variety of purposes for its diverse user base:

-

Streamlined Payment Processes: Individuals and businesses can manage their bill payments effortlessly. Whether it is utility bills, credit card dues, or EMI installments, the website facilitates quick and secure transactions.

-

Efficient Loan Management: Customers can view detailed information about their loans, including disbursement statuses, repayment schedules, and outstanding amounts. This transparency helps in planning finances and avoiding defaults.

-

Centralized Account Management: The website offers a comprehensive view of all your banking accounts. With features like real-time updates and detailed transaction histories, users can keep track of their financial health at a glance.

-

Enhanced Collection Mechanisms for Businesses: For corporate users, especially small and medium-sized enterprises (SMEs), the portal simplifies the process of collecting payments from customers. Its integrated features reduce administrative burdens and help in maintaining steady cash flows.

Benefits of Tallyman Axis Login and the Axisbank Collection Website

The advantages of using the Tallyman Axis Login portal extend far beyond the convenience of digital access. Here are some of the primary benefits:

-

Enhanced Convenience: With round-the-clock access to banking services, users can manage transactions without being constrained by branch timings. This level of convenience is invaluable in today’s fast-paced environment.

-

Improved Security: The dual-layered authentication process and robust encryption protocols ensure that users’ financial data is well-protected, giving them peace of mind when carrying out sensitive transactions.

-

Time and Cost Efficiency: The ability to perform multiple banking activities from a single portal reduces the need to visit physical branches, thereby saving both time and travel expenses. This efficiency translates into cost savings over the long term.

-

Real-Time Financial Management: Access to real-time updates and detailed transaction information enables users to make informed decisions quickly. Whether it’s managing budgets or tracking expenses, the immediacy of information is a significant advantage.

-

Sustainability and Eco-Friendliness: Digital platforms like the Axisbank Collection website reduce the need for paper-based documentation. This not only streamlines processes but also contributes to environmental sustainability—a value increasingly embraced by modern consumers.

Final Thoughts

The Tallyman Axis Login portal and the Axisbank Collection Official Website epitomize the transformation of traditional banking into a digitally empowered experience. By integrating advanced features with user-centric design and stringent security measures, Axis Bank has created a platform that meets the diverse needs of its customers. Whether for everyday transactions, loan management, or business collection services, the portal offers a reliable, efficient, and secure solution. As digital banking continues to evolve, platforms like these set a benchmark for excellence in financial services, ensuring that users across India can manage their finances with unprecedented ease and confidence.

In embracing digital transformation, Axis Bank not only enhances the customer experience but also reinforces its commitment to innovation and security in the financial sector. The Tallyman Axis Login is more than just a gateway—it is a testament to the bank’s vision of a future where banking is seamless, secure, and accessible to all.

Frequently Asked Questions (FAQs)

1. What is the Tallyman Axis Login?

Ans: The Tallyman Axis Login is a secure portal provided by Axis Bank that serves as the gateway to the Axisbank Collection Official Website. It allows users to access a wide range of banking and collection services through a user-friendly interface enhanced with robust security measures.

2. How do I log in to the Axisbank Collection website?

Ans: To log in, simply visit the official Axisbank Collection website and locate the Tallyman Axis Login section. Enter your unique credentials, which typically include a user ID and password. The process may also require multi-factor authentication (MFA), such as an OTP sent to your registered mobile number or email, ensuring that only authorized users can access the account.

3. What security measures are implemented on the portal?

Ans: Axis Bank has incorporated advanced security features into the Tallyman Axis Login. These include state-of-the-art encryption technologies, multi-factor authentication, and continuous monitoring to protect personal and financial data from unauthorized access and cyber threats.

4. What services can I access through the Axisbank Collection Official Website?

Ans: The website offers a comprehensive range of collection services including, but not limited to, real-time transaction updates, bill payments, loan management, and detailed account statements. It also caters to business users by providing tools for efficient payment collection and account management.

5. Is the Axisbank Collection website mobile-friendly?

Ans: Yes, the website is fully optimized for mobile devices. Whether you are using a smartphone or tablet, you can seamlessly access all its features and services, ensuring that you manage your financial transactions on the go without any hassle.

6. Who can benefit from using the Axisbank Collection website?

Ans: Both individual and corporate users can benefit from the portal. Individuals can manage personal finances, bill payments, and loans, while businesses can streamline collection processes, track payments, and manage cash flows efficiently. This versatility makes it an ideal solution for a wide range of financial needs.

7. What should I do if I encounter issues during the login process?

Ans: If you experience any difficulties logging in, the website offers integrated customer support. You can reach out via live chat, email, or phone for immediate assistance. Additionally, ensure that your internet connection is stable and that you are using the correct login credentials. In case of persistent issues, contacting customer support is the best way to resolve the problem quickly.

Anantha Nageswaran is the chief editor and writer at TheBusinessBlaze.com. He specialises in business, finance, insurance, loan investment topics. With a strong background in business-finance and a passion for demystifying complex concepts, Anantha brings a unique perspective to his writing.